Small businesses will be able to claim 120% of the costs for digital platforms such as inndox

Tax breaks for small businesses investing in technology and skills

By business reporter Michael Janda

The tax break for businesses that invest in new technology applies until June 30th 2023.

For every hundred dollars a small business spends on digital technologies — like cloud computing, e-invoicing, cyber security and web design — they will get a $120 tax deduction.

Investments of up to $100,000 per year will be supported by this new measure.

The additional tax deduction will be available for eligible spending incurred until June 30, 2023, for technology investments and June 30, 2024, for staff training.

The additional technology deduction applies to business expenses and depreciating assets that support their digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud-based services.

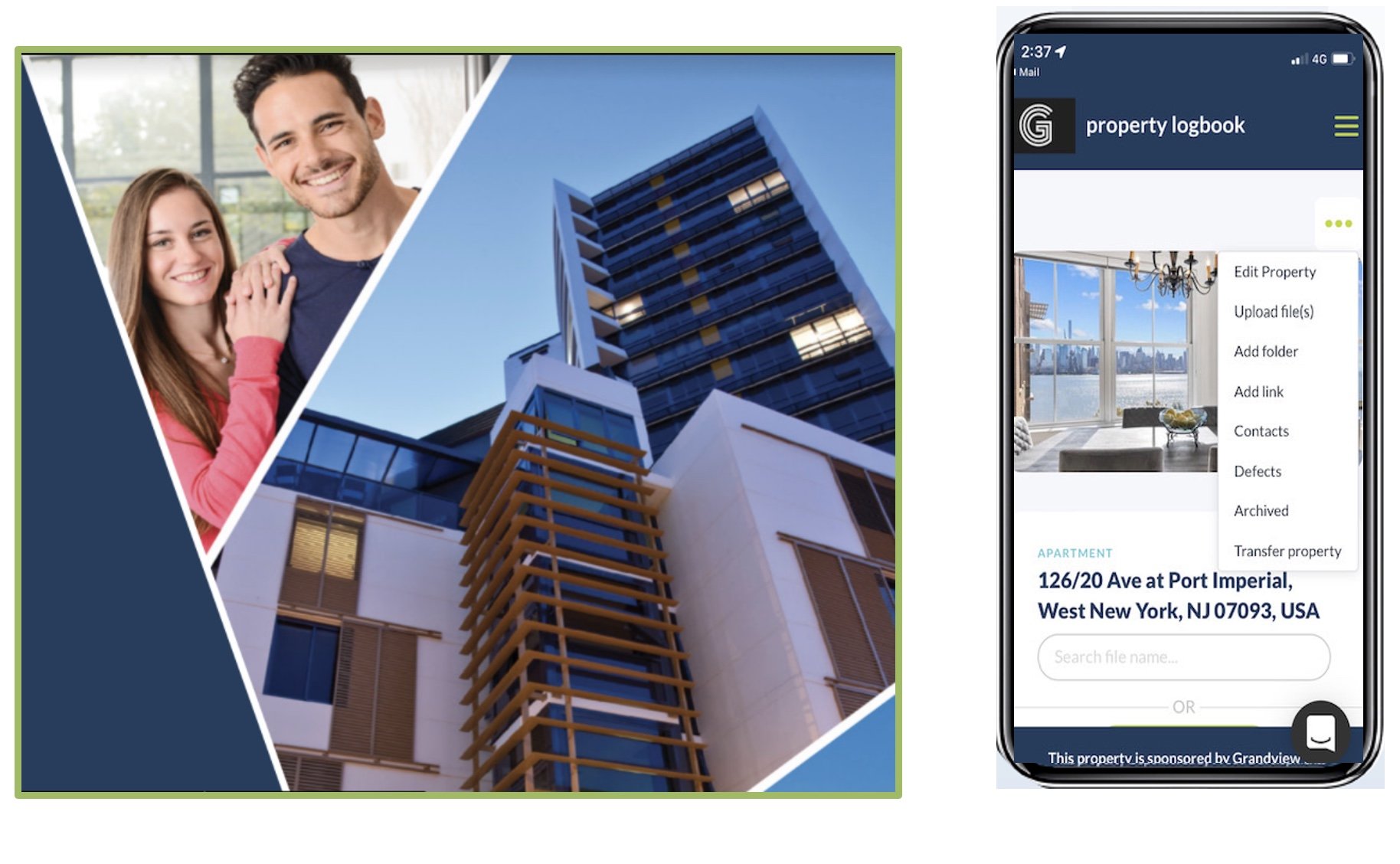

Streamline your handovers, defects management and after-sales service with inndox and use the government rebate to claim all your subscription costs and more.

Current customers can contact us to arrange an annual invoice to make the most of the claim. New customers can get started now or book in a demo here

,